When a drug’s patent expires, it doesn’t just mean a cheaper version hits the shelf. It means your prescription could change, your insurance formulary could shift, and your out-of-pocket cost might drop-or spike-overnight. For patients on long-term meds, and for hospitals and insurers managing budgets, patent expiry isn’t a future event. It’s a ticking clock. And if you’re not planning for it, you’re already behind.

Why Patent Expiry Matters More Than You Think

Most people think patents last 20 years. But that’s not how it works in real life. Drug companies spend 8-12 years getting FDA approval before they even start selling. That leaves only 7-10 years of real market exclusivity. Once that window closes, generics flood in. And they’re not just cheaper-they’re often 80-85% less expensive than the brand-name version. But here’s the catch: not all drugs are created equal. Small-molecule pills like statins or blood pressure meds drop to 90% generic market share within a year. But biologics-injectable drugs for arthritis, cancer, or autoimmune diseases-are a different story. These complex drugs take years to copy. Even after their patents expire, biosimilars (the generic version of biologics) only capture about 38% of prescriptions after two years. That’s because manufacturing them is like cloning a living organism, not copying a pill. And drugmakers aren’t just waiting for the patent to expire. They’re stacking patents. One drug might have 20+ patents covering everything from the chemical formula to the pill coating to the way it’s taken. This is called a “patent thicket.” It’s legal, but it delays competition. In fact, nearly 80% of the top 100 selling drugs have dozens of secondary patents protecting them. That’s why some drugs stay expensive long after their main patent expires.What Happens When a Patent Expires?

Picture this: You’ve been taking Humira for rheumatoid arthritis for five years. Your copay is $50 a month. Then, in 2025, the patent expires. Within six months, six different biosimilars hit the market. Your pharmacy says they’re switching you to one of them. You’re confused. You’re worried. You’ve heard stories about people having flare-ups after switching. This isn’t hypothetical. In 2022, 42% of Medicare Part D patients reported being forced to switch drugs after a patent expired. And 37% of those patients said they had side effects they didn’t have before. Here’s what actually happens when a patent expires:- Month 0-3: The first generic or biosimilar enters. It’s often priced at 30-50% of the brand. But insurers don’t always put it on their formulary right away.

- Month 4-9: More competitors arrive. Prices drop further. Some generics are cheaper than others because of how they’re made or who makes them.

- Month 10-18: The brand-name drug’s sales drop to 16% of what they were. That’s when insurers start pushing hard for generics.

- Month 18+: Price stabilizes. But in the U.S., you won’t see the same deep discounts as in Europe. Why? Because of rebates, pharmacy benefit managers (PBMs), and complex pricing deals that hide the real cost.

What Patients Should Do

If you’re on a drug that’s about to lose patent protection, here’s what you need to do:- Find out when your drug’s patent expires. Check Drugs.com, the FDA’s Orange Book, or ask your pharmacist. Many drugs have clear expiry dates listed. For example, Humira’s main patent expired in December 2023 in the U.S., but biosimilars didn’t become widely available until 2024.

- Ask your doctor if switching is safe. Generics must be bioequivalent-meaning they work the same way 80-125% of the time. But inactive ingredients (fillers, dyes, preservatives) can cause reactions. If you have allergies, sensitivities, or autoimmune conditions, ask for a brand-name exception.

- Check your insurance plan’s formulary. Your copay might change. Sometimes, the generic is cheaper. Sometimes, the brand is still covered better because of rebate deals. Call your insurer and ask: “What’s my cost for the generic version after the patent expires?”

- Don’t assume the switch is automatic. Pharmacies can’t switch your prescription without your doctor’s approval unless your plan allows it. If you’re worried, ask your doctor to write “Dispense as Written” on the prescription.

- Track your symptoms after switching. If you feel worse, report it to your doctor. Some patients need to try multiple generics before finding one that works.

What Healthcare Systems Should Do

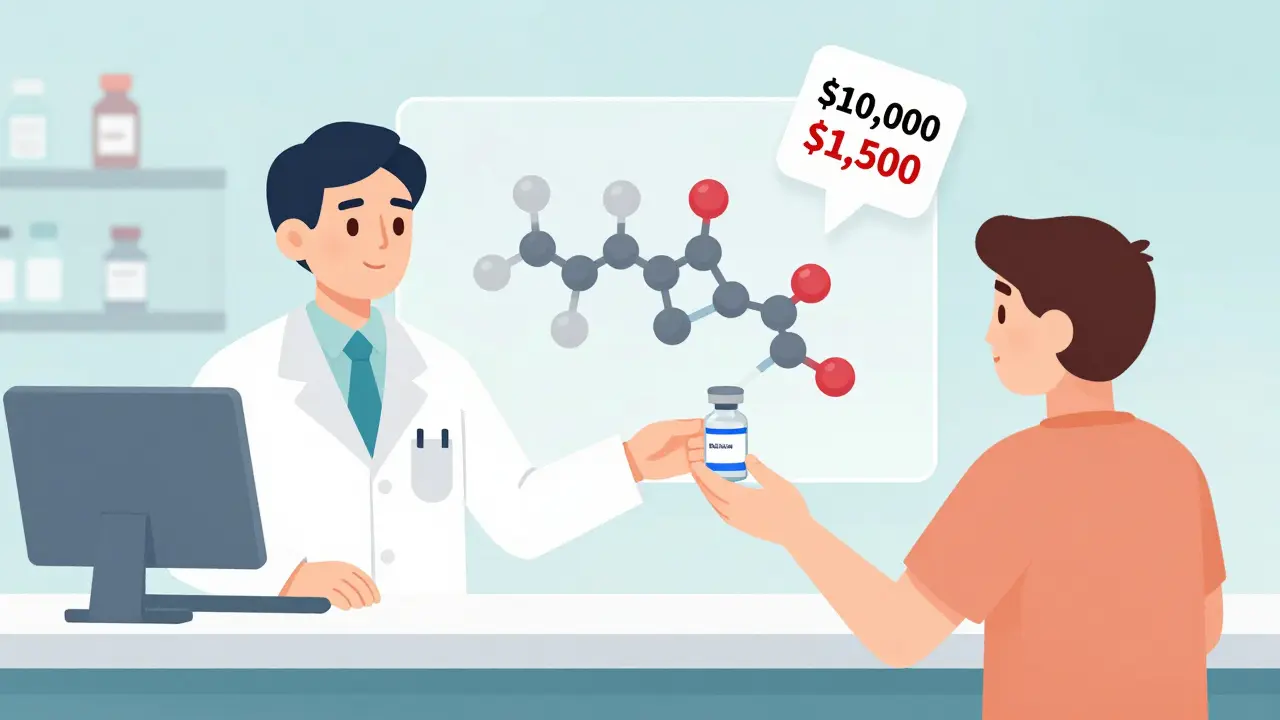

Hospitals, clinics, and insurers have a bigger job. They’re managing hundreds of drugs, thousands of patients, and millions in budgets. When a $10,000-a-year drug becomes a $1,500 generic, that’s a huge win-if they plan right. Here’s what works:- Start planning 24 months before expiry. The best systems don’t wait for the patent to expire. They start analyzing the pipeline 2 years out. Who’s making the generic? Is it approved? Are there delays? What’s the expected price?

- Build a patent expiry task force. This isn’t just the pharmacy team. It’s finance, clinical staff, contracting, and IT. They need to track over 1,400 patent expirations per year in the U.S. alone.

- Use software to predict expiry dates. Tools like Symphony Health’s PatentSight or IQVIA’s LOE Tracker help systems see which drugs are coming up. One health system reduced surprises by 65% after adopting this.

- Negotiate with manufacturers before the drop. Brand-name companies often offer deep discounts to keep market share. Some even launch their own “authorized generics” (same drug, cheaper price, same company). Systems that lock in these deals early save more.

- Update clinical guidelines and train staff. Doctors need to know when to switch, when not to, and how to explain it to patients. A 2023 study found that clinics with training programs had 35% fewer patient discontinuations after a switch.

Why the U.S. Is Different

In Europe, when a drug loses its patent, prices drop to 30-40% of the original cost within weeks. Why? Because governments set a single reference price. If a brand is $100, the generic can’t be more than $40. In the U.S., there’s no reference pricing. Instead, you have a maze of rebates, PBMs, and negotiated contracts. A drug might be listed at $100, but the insurer pays $60 after a rebate. The generic might be priced at $20, but the PBM takes $5, and the pharmacy gets $10. The patient still pays $15. That’s why U.S. patients often see slower savings. And why some systems don’t benefit as much as they should.

The Big Picture: 6 Billion at Risk

Between 2023 and 2028, $356 billion in branded drug sales are at risk from patent expirations. The biggest hits? Immunology drugs like Humira, neuroscience drugs like Alzheimer’s treatments, and cancer therapies. That’s not just money. It’s access. If systems plan well, patients get cheaper meds. If they don’t, patients get caught in the middle-switched without warning, confused by new brands, or stuck with expensive drugs because no one bothered to prepare.What’s Changing Fast

New laws are starting to shift the game:- The 2022 Inflation Reduction Act lets Medicare negotiate prices for some drugs after they lose patent protection. Starting in 2026, 10-20 drugs per year will be affected.

- The CREATES Act is cracking down on “pay-for-delay” deals-where brand companies pay generics to stay off the market. These deals dropped 35% in 2023.

- The 2024 Pharmaceutical Patent Reform Act is in Congress. If passed, it could shorten generic entry delays by 6-9 months.

- AI tools are now predicting patent expirations with 89% accuracy, up from 65% just two years ago.

Bottom Line: Don’t Wait Until It’s Too Late

Patent expiry isn’t a problem for drug companies. It’s a problem for patients and systems that don’t plan ahead. If you’re a patient: Know your drug. Ask questions. Don’t accept a switch without understanding why. If you’re part of a healthcare system: Start tracking expirations now. Build a team. Use data. Negotiate early. Train your staff. The savings are real. But they only happen when someone is ready.What happens to the price of a drug after its patent expires?

After a patent expires, generic or biosimilar versions enter the market. For small-molecule drugs, prices typically drop by 70-90% within the first year. For biologics, the drop is slower-20-40% initially-because biosimilars are harder and more expensive to produce. In the U.S., prices don’t fall as fast as in Europe due to complex rebate systems and pharmacy benefit manager deals.

Can I be switched to a generic without my doctor’s permission?

In many cases, yes-especially if your insurance plan allows automatic substitution. But your doctor can prevent this by writing “Dispense as Written” on your prescription. Always check with your pharmacist and doctor before any switch, especially if you have chronic conditions or allergies.

Why do some patients have side effects after switching to generics?

Generic drugs must be bioequivalent, meaning they deliver the same active ingredient in the same amount. But they can contain different inactive ingredients-like fillers, dyes, or preservatives-that some people react to. For example, a patient allergic to a dye in one generic version might have a rash, even though the active drug is identical.

How do I find out when my drug’s patent expires?

Check the FDA’s Orange Book online, which lists patent and exclusivity dates for approved drugs. You can also ask your pharmacist or use tools like Drugs.com. For biologics, look for the “Reference Product” listing and check the Biologics License Application (BLA) date. Most major drugs have this information publicly available.

Are biosimilars as effective as the original biologic drugs?

Yes, biosimilars are required by the FDA to show no clinically meaningful differences in safety, purity, or potency compared to the original biologic. Clinical trials prove they work the same way. However, because biologics are made from living cells, tiny manufacturing differences can affect how they behave in some patients. That’s why some doctors prefer to monitor patients closely after switching.

Why do some health systems save more than others after patent expiry?

Systems that start planning 24 months before expiry save 22% more than those who wait until 12 months out. The difference comes from negotiating early, updating formularies in advance, training staff, and using data tools to predict which generics will be cheapest. Reactive systems often miss the best deals and end up paying more.

Allison Pannabekcer

December 19, 2025 AT 10:57I’ve been on Humira for six years and just got switched to a biosimilar last month. No flare-ups, no weird rashes-just a $40 copay instead of $120. I was scared, but my rheumatologist walked me through it. Turns out, the FDA makes sure these things work the same. Trust the science, not the fear.

Also, if you’re worried about inactive ingredients, ask for the manufacturer’s info. Some generics use cornstarch, others use lactose. If you’re gluten-sensitive or allergic, that matters more than you think.

James Stearns

December 21, 2025 AT 05:46It is imperative to note that the conflation of ‘generic’ with ‘equivalent’ constitutes a fundamental misapprehension of pharmaceutical biochemistry. The regulatory framework governing bioequivalence permits a 20% variance in pharmacokinetic parameters, which, when extrapolated across a population of immunocompromised individuals, represents a non-trivial clinical risk. One must not be swayed by the rhetoric of cost-efficiency at the expense of therapeutic integrity.

Nina Stacey

December 23, 2025 AT 01:28okay so i just found out my insurance is switching me to a generic for my diabetes med next month and i’m kinda freaking out but also kinda excited because i’ve been paying like 80 bucks a month and now it’s gonna be 12 but what if i get weird side effects like my cousin did with her blood pressure med she got dizzy all the time and no one told her it was the filler in the pill and now she’s on a different one and i just wish there was a website where you could see what’s in each generic version like a full ingredient list because i don’t trust pharmacies to tell me the truth and also why does it take so long for doctors to even talk about this stuff like why are we only hearing about it when the switch happens like why not send us a letter six months in advance or something

also can someone explain what a pBM is because i keep hearing that word and i think it’s like a middleman but i’m not sure and why do they get to keep money from my savings like that’s wild

Dominic Suyo

December 24, 2025 AT 00:25Let’s be real-the U.S. pharmaceutical system is a dumpster fire wrapped in a patent thicket and set on fire by PBMs who are basically corporate vampires sucking the blood out of every patient’s copay. You think you’re saving money? Nah. You’re just getting handed a cheaper pill while the middlemen pocket the difference in a shell game no one understands.

And don’t get me started on biosimilars. They’re not generics. They’re like photocopies of a Picasso. You get the shape, but the soul? Gone. And now we’re forcing patients to gamble with their immune systems because ‘it’s cheaper.’

Meanwhile, the same companies that made $20 billion off Humira are now selling their own ‘authorized generics’ at 30% off. Classic. They’re not competing-they’re just changing the label.

Kevin Motta Top

December 24, 2025 AT 05:17My dad switched to a generic statin after his patent expired. Saved him $900 a year. No issues. Simple as that. The fear is real, but the data is clearer.

Aadil Munshi

December 24, 2025 AT 15:35Interesting how everyone acts like patent expiry is some kind of crisis. In India, generics are the norm. People take them for decades without a hitch. You think your body is too special? Maybe it’s the system that’s broken, not the medicine.

Also, the whole ‘inactive ingredients cause reactions’ thing? That’s a marketing tactic by brand-name companies to scare people. If you’re allergic to dyes, you’re allergic to dyes-whether it’s in the brand or the generic. Don’t let them make you feel guilty for saving money.

Frank Drewery

December 26, 2025 AT 00:26I just wanted to say thank you for writing this. I’ve been on a biologic for lupus and was terrified about switching. Your breakdown of the timeline and what to ask my doctor helped me feel less alone. I called my insurer and found out my generic copay is $10. I cried a little. Not from sadness-from relief.

Sajith Shams

December 27, 2025 AT 10:56You’re all missing the point. The real problem isn’t the patent expiry-it’s that we let corporations control healthcare. The FDA approves generics, sure, but the real power lies with PBMs and hospital formularies that choose what gets pushed based on kickbacks, not outcomes. If you want real change, stop blaming generics. Blame the system that lets a $10,000 drug become a $1,500 one while the patient still pays $15 because the rebate goes to a middleman who never met you.

And no, AI predicting patent expirations won’t fix that. Only breaking up the PBM monopoly will.

Chris Davidson

December 28, 2025 AT 14:06Patients must understand that the transition from branded to generic is not a medical decision but an economic one. The physician’s role is advisory. The insurer dictates the formulary. The pharmacy executes the substitution. The patient has little to no agency unless they demand otherwise. Document everything. In writing. Always.

Dispense as written is not a suggestion. It is a legal safeguard. Use it.